- #Chase sapphire international transaction fee full#

- #Chase sapphire international transaction fee license#

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices. The privacy practices of those third parties may differ from those of Chime.

#Chase sapphire international transaction fee full#

See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.īy clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere. Please see back of your Card for its issuing bank. and may be used everywhere Visa credit cards are accepted.

#Chase sapphire international transaction fee license#

The Chime Visa® Credit Builder Card and the Chime Visa® Cash Rewards Card are issued by Stride Bank pursuant to a license from Visa U.S.A. and may be used everywhere Visa debit cards are accepted. or Stride Bank pursuant to a license from Visa U.S.A. The Chime Visa® Debit Card is issued by The Bancorp Bank, N.A. 15īanking services provided by The Bancorp Bank, N.A. And you can build credit with everyday purchases and on-time payments. If you want a straightforward secured credit card, the secured Chime Credit Builder Visa ® Credit Card could be the right choice.Ĭredit Builder has no foreign transaction fees or annual fees, so using your card overseas won’t cost anything extra. People who don’t mind paying a higher annual fee for travel benefits.Ĭardmembers earn 5% cash back in selected categories each quarter, up to the first $1,500 in purchases, and 1% unlimited cash back on everything else.Įveryday spenders who want a higher cash back rewards rate with no annual fee. Travelers who want to earn miles and don’t mind paying an annual fee.Ĭardmembers can earn 1 to 5 points per dollar on purchases. Travelers who want to earn a flat rewards rate with no annual fee.Ĭardmembers earn unlimited 2x miles per dollar on purchases. People who want to build credit history while paying no interest 10 or foreign transaction fees, even when traveling.Ĭardmembers earn unlimited 1.5 points per dollar on purchases. Chime does not endorse, and is not affiliated with, any of these third-party financial institutions. Here are some credit cards with no foreign transaction fees.ĭisclaimer: The use of the company names below is for informational purposes only. When comparing cards, it’s helpful to look at the bigger picture. You have options if you’re looking for a credit card with no foreign transaction fees. dollars, your bank might charge a foreign transaction fee to convert the currency. If the merchant processes the transaction in South Korean won instead of U.S. For example, let’s say you buy clothes online from a merchant in South Korea. Sometimes, you don’t have to leave your home country to be charged a foreign transaction fee.

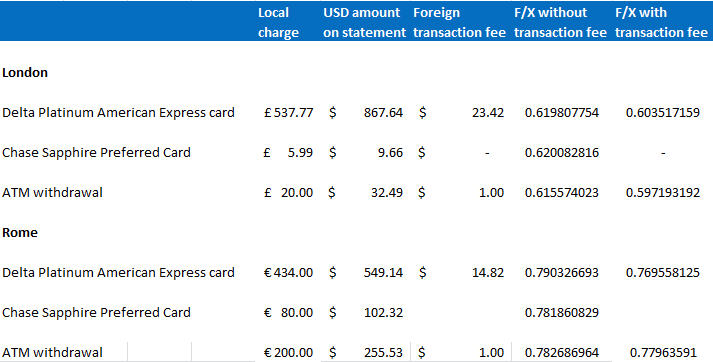

Usage fees (charged by the ATM’s owner).Out-of-network ATM fees (charged by your financial institution).Some of those fees could include the following: You may also have extra fees for ATM withdrawals at an international ATM. This differs from a monthly maintenance fee you might pay for an account. Get 50% more value when you redeem your points for travel through Chase Ultimate Rewards®.A foreign transaction fee is an amount that credit card companies (and financial institutions) can charge when you use your card to make purchases in a foreign country.Ĭard issuers can charge foreign transaction fees to help cover the cost of converting currencies for international purchases.Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually.$300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.That's $900 toward travel when you redeem through Chase Ultimate Rewards® Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

0 kommentar(er)

0 kommentar(er)